Paris Panthéon by Jean-Pierre Lavoie

![]()

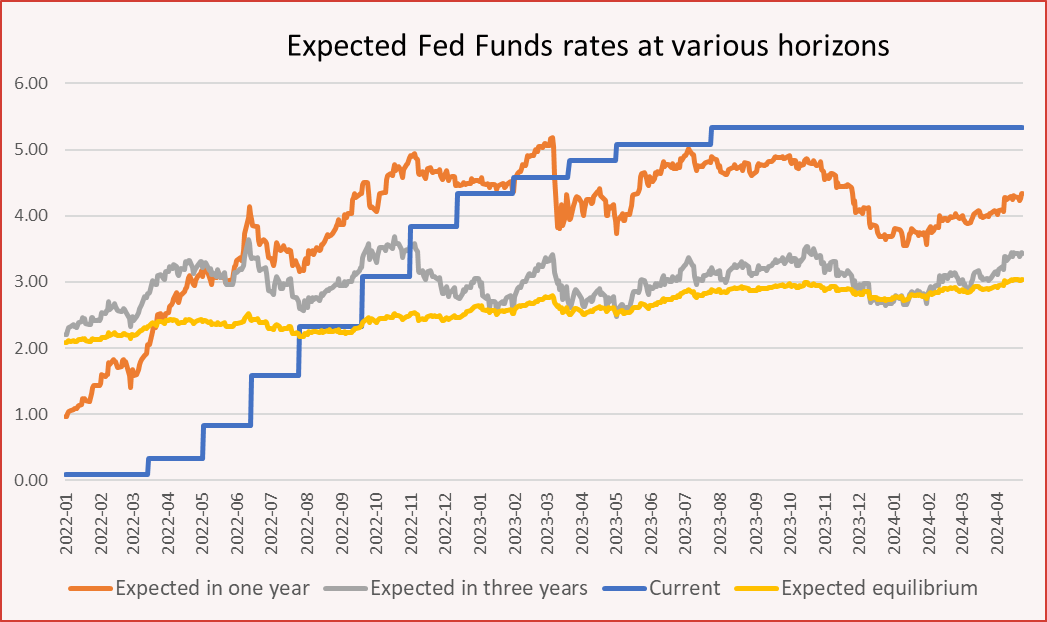

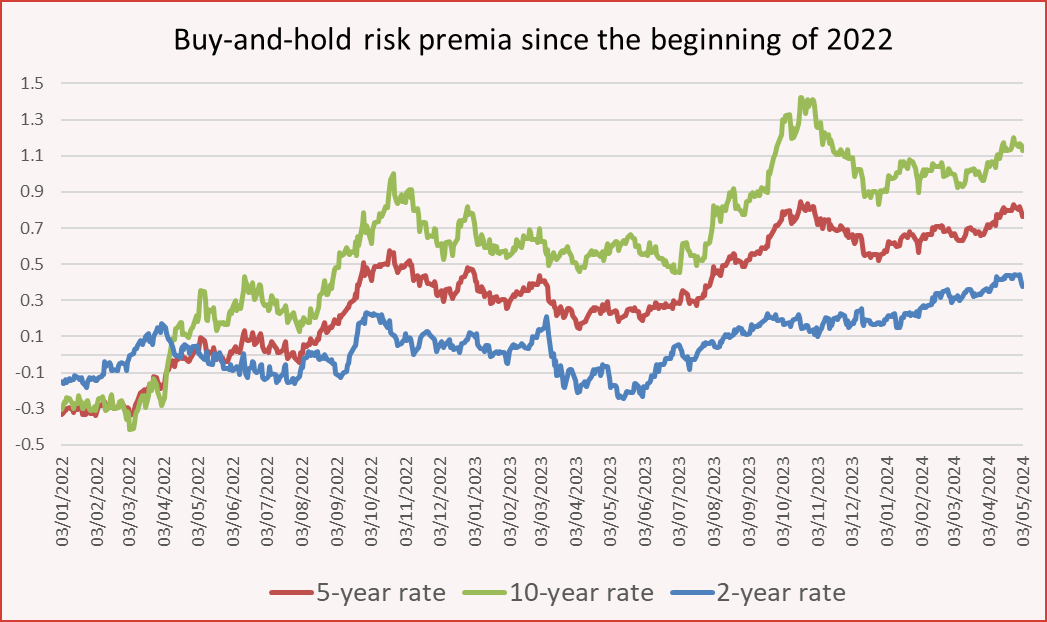

Thanks to our good understanding of the dynamics of risk premia (see our background papers), we have developed a model for extracting risk premia on government bonds that is much more efficient than existing models. Everyone is talking about “term premium” or “buy-and-hold” risk premia today, but this is where you will find the most realistic daily estimates for US Treasuries (updated every evening around 4:30 PM ET)!

This market plays a central role in the valuation of all other assets. This is especially true today in a context of still high inflation and tighter monetary policies.

We are available to present our original work to financial professionals (practitioners or academics) interested in the evaluation of risk premia. You can contact us at contact@riskpremium.com

Due to other priorities, in 2024 we have temporarily stopped publishing detailed daily commentary of how the news of the day have impacted expected Fed funds rates and risk premia. But our indicators for the April 23, 2024 session are available in USTreasuries-23042024

Detailed daily analysis until 2023 are still available on our daily monitoring page.

The main results since the beginning of 2022, also presented in the following two graphs, are available in the excel file RiskPremia-UST-V

See also Our Guide to Understand (And Trade) The US Treasuries Yield Curve.

![]()

Grâce à notre bonne compréhension de la dynamique des primes de risque (voir nos “background papers”), nous avons développé un modèle d’extraction des primes de risque sur les obligations gouvernementales beaucoup plus efficace que les modèles existants. Tout le monde parle aujourd’hui des “term premium” ou des primes de risque “buy-and-hold”, mais c’est ici que vous trouverez les estimations quotidiennes les plus réalistes pour les bons du Trésor américain!

Ce marché joue un rôle central dans la valorisation de tous les autres actifs. C’est particulièrement vrai aujourd’hui dans un contexte d’inflation élevée et de durcissement des politiques monétaires.

Nous sommes disponibles pour présenter nos travaux originaux aux professionnels de la finance (praticiens ou académiques) intéressés par l’évaluation des primes de risque. Vous pouvez nous contacter à contact@riskpremium.com

Les taux anticipés et les primes de risque (graphiques et fichier excel) sont mis à jour quotidiennement après la fermeture des marchés américains.

Voir aussi Our Guide to Understand (And Trade) The US Treasuries Yield Curve.

What Is New ?

Key Background Papers

Latest Market Analysis

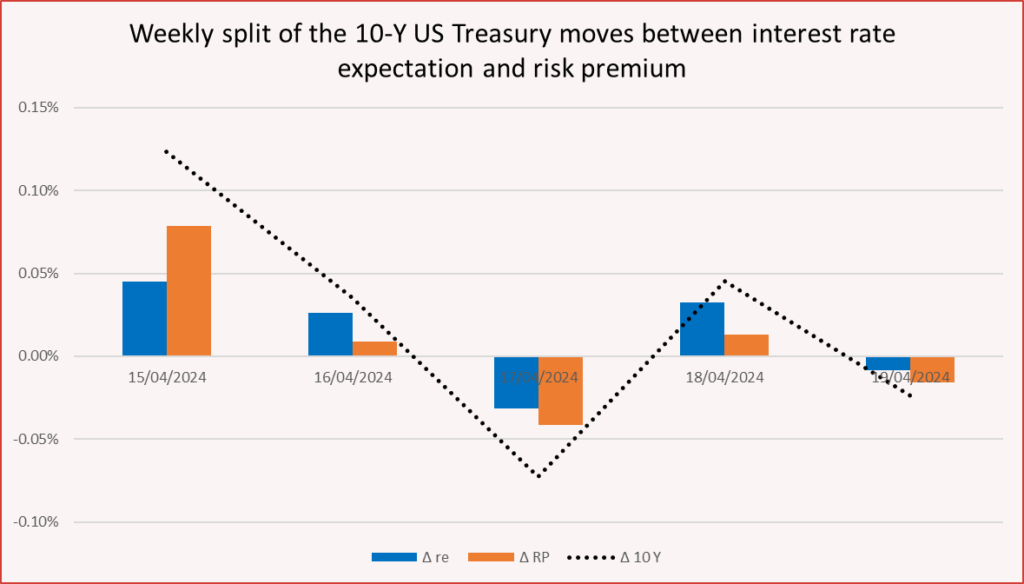

Weekly risk premia analysis for 10-year US Treasuries*

* Contributions of risk premia (RP) and Fed funds rates expectations (re) to daily changes in the US 10-year yield / April 15 – 19, 2024